As we look back at 2023 investors can once again smile as markets have ticked higher helping unitholders catch-up on losses suffered in 2022. The Canadian TSX surged 8%, and the following markets in Canadian currency performed as follows; the S&P 500 surged 22.42%, the MSCI Europe, Australia and Far East index increased 11.95% and the MSCI World Index was up 18.5% in part thanks to the American performance. I would also be remiss to not mention that the S&P Canadian Aggregate Bond Index was up 6.27%.

These numbers are in part thanks to the fact that inflation is seemingly under control in the US and somewhat so in Canada. Both the Federal Reserve Chairperson Jerome Powell and the Bond Markets point towards interest rate reductions being likely in 2024. Although this is all just speculation and conjecture, as the last Federal Reserve meeting on December 12 & 13 made no specific mention of reducing interest rates, the tone and wording of the presentation and supporting print documents indicated a less harsh stance. To us financial people that is a sign that things are to come, just when.

Why is this important for all to understand; simply put, if inflation is in check, then there is no need for high interest rates to combat rising inflation. As we all have come to learn in the last couple of years, increases to interest rates of such a large magnitude inflict punishment on both investors and homeowners with a mortgage alike. No one is immune. Nor I or any of the talking heads can predict the future. If inflation is controlled or even reduced, thanks in part to what has been put in place over the last few years, there just might be a pot of gold at the end of the rainbow. Of course, the opposite can be said, if inflation once again becomes difficult to reign in, then all bets are off, and things can get a whole lot worse.

A couple of other important points that need to be made regarding market performance, especially in the USA, are that ‘the Big 7’ stocks – Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft and Tesla accounted for about 50% of the US market returns in 2023. I am reminded of the ‘Nifty 50’ stocks of the early 70’s. Even those stocks eventually reverted to the mean. Some of those stocks still exist today and have performed at least as well as the broad markets over time. Keep in mind, one should not go chasing returns as you just might get disappointed.

Another theme worth mentioning is Artificial Intelligence. This technology is and will be a big part of our future. It is shaking up the whole world in many aspects; industrial applications, financial analysis, and education among a few of the affected areas. It can be a very important directional change in the way we produce, create and make decisions which in turn can undervalue human judgement and intervention.

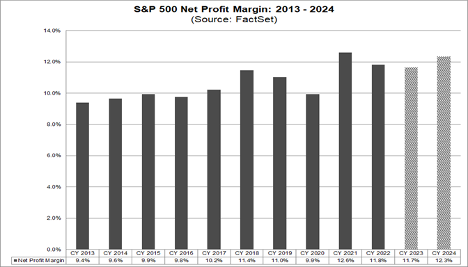

My last honorable mention is corporate profit. As I wrote in my last newsletter of 2023, the late year comeback of S&P 500 corporate earnings also helped get the current market turn around in motion and reverse the losing trend of corporate revenue in early 2023. Over 80% of companies that reported in November 2023, produced 7.1% better than expected profit.

Going forward, according to FactSet projections published December 11th 2023, the 2024 Net Profit Margin projected for the S&P 500 stocks is around 12.3%.

If they are correct, these numbers can translate into a potential 5.5% growth in revenue. Here’s to hoping!

In conclusion, 2023 was a respectable year for investors. These positive numbers and potential for the future given the recent past lends well for 2024 also having a positive outcome. We can never look at the past to predict the future, but things are looking up. Barring some yet unforeseen external factor, we are bullish on the future for 2024.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by John A. Leroux, an Investment Funds Advisor with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc.

The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities. Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.