John’s Take:

How higher interest rates adds fuel to the gap.

The wealthiest 20% of households controlled nearly 68% of the total net worth in Canada in the first quarter of 2023, while the least wealthy 40% accounted for 2.7%.

Income and wealth inequality among Canadian households is increasing at record speed amid inflation and rising interest rates, and younger households are bearing the financial burden, a new report from Statistics Canada shows.

The wealthiest 20 percent of households controlled more than two-thirds — nearly 68 percent — of the total net worth in Canada in the first quarter of 2023, while the least wealthy 40 per cent accounted for 2.7 per cent, the federal agency reported on Tuesday.

The gap in net worth between the most and least wealthy increased 1.1 percentage points in the first quarter relative to the same time a year before, marking the fastest increase on record.

Economists say that the growing income and wealth gap reflects the impacts of the Bank of Canada’s aggressive rate-hiking campaign on indebted homeowners and low-income households that are being squeezed by rising interest rates, which are increasing the cost of servicing debt. And it’s the least wealthy and younger households who are feeling the pinch of inflation particularly hard.

“Lower income and younger households tend to hold entry level positions and service jobs in the accommodation and food industry,” said Gillian Petit, a research associate at the department of economics at the University of Calgary. “These wages tend not to keep up with inflation.”

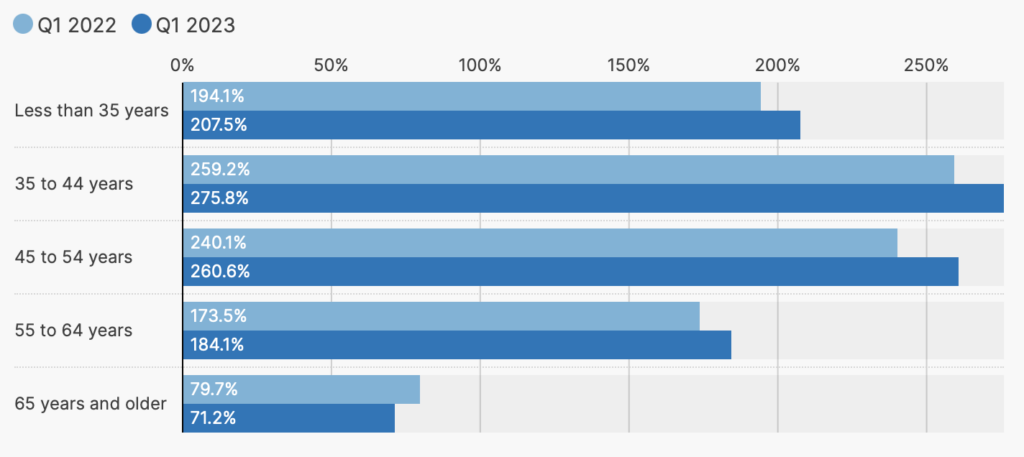

Debt-to-income ratio by age group of major income earner

For younger homeowners rising interest rates mean “their mortgages are becoming more expensive and at the same time they’re not necessarily making more income, increasing that debt-to-income ratio,” Petit said.

Debt-to-income ratios for younger and core working-age groups were at their highest rates on record, and well above pre-pandemic rates at the end of 2019, the StatCan data shows. The ratio for the youngest households reached 207.5 per cent in the first quarter, an increase of 13.4 percentage points from a year ago.

Core working-age households also experienced unprecedented increases in their debt-to-income ratios, reaching 275.8 per cent for households aged 35 to 44 years — up 16.6 percentage points from a year earlier — and reaching 260.6 per cent for households aged 45 to 54 years, a 20.5 percentage point jump.

Although households of younger workers may have increased their income over the years, “high inflation and interest rates continued to restrain their ability to make ends meet, as these households tend to hold higher balances on credit cards and mortgages relative to older age groups,” StatCan said in the report.

Least wealthy households were most affected by the recent economic pressures, seeing their net worth decrease by 13.8 percent compared with the same quarter last year, and more than triple the rate of decrease for the wealthiest, according to StatCan. Average net worth decreased the most for households aged less than 35 years, down 8.7 percent from a year before, compared with a decrease of 1.8 per cent for households aged 55 to 64 years.

And the drop in net worth for all households was due “almost entirely” to real estate, the agency said, as the average value of real estate held by households declined by 8.6 per cent compared with a year ago.

Statistics Canada in June reported that Canadians owed $1.85 for every dollar of disposable income in the first quarter of 2023. And Canada has the highest level of household debt in the G7, according to the Canadian Mortgage and Housing Corp., with mortgages making up around three-quarters of that debt.

“Persistently high interest rates and inflation are likely to continue to strain households’ ability to make ends meet without going further into debt, especially vulnerable groups, such as those with the lowest income, the least wealth and those of younger age groups,” StatCan said