John’s Take:

Numbers speak louder than words, are you ready?

An interesting article in the New Economies newsletter by Marine Auge, title The Great Wealth Transfer: A New Era in Wealth Management

Here is a summary of the article.

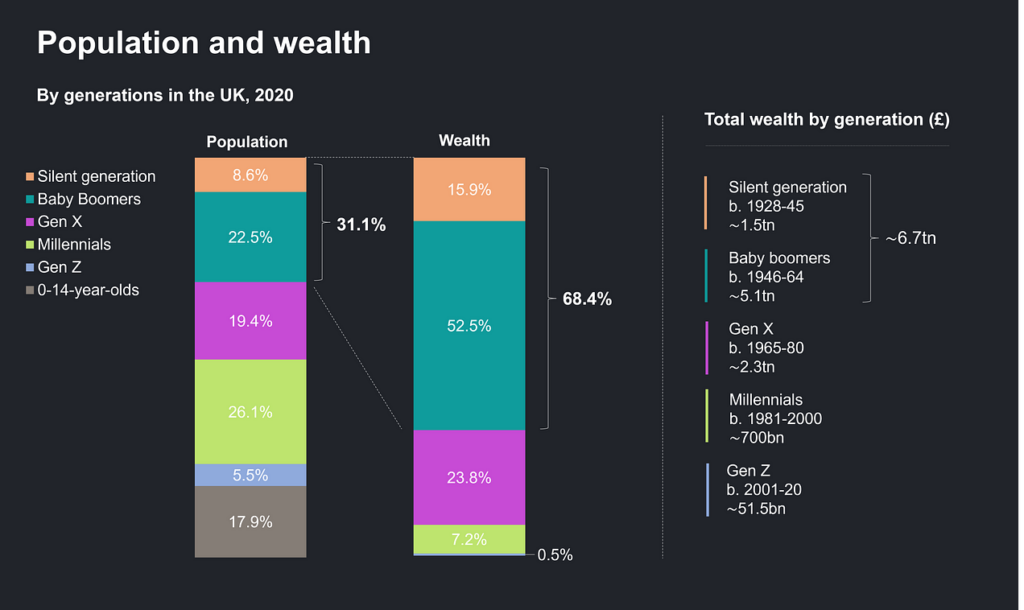

The wealth management industry is facing a major transformation over the coming decades due to the “Great Wealth Transfer” – an estimated $84 trillion in wealth that will shift from Baby Boomers to Millennials and Gen Z in the US alone. This presents both significant opportunities and challenges for traditional wealth management firms.

Source: The Financial Times, 2024, The great wealth transfer is coming (but are advisers prepared?)

Many legacy wealth management firms are struggling with outdated, siloed technology systems that lack integration and flexibility. Nearly 50% report their platforms are not fully integrated, leading to inefficiencies, higher costs, and subpar client experiences. At the same time, client expectations are rapidly evolving, especially among younger generations, who favor digital-first, personalized wealth management services.

In response, a new wave of fintech startups is emerging with innovative solutions:

Serving the elderly/retirees:

- Ensuring longevity financing through digital retirement planning tools

- Protecting seniors’ finances with bill management and fraud prevention solutions

- Modernizing end-of-life planning with secure digital vaults and AI-powered estate planning

- Serving high-net-worth (HNW) clients:

Wealth aggregation platforms that consolidate financial data from multiple sources:

- AI-powered portfolio construction tools for hyper-personalized investment strategies

- Integrated “front-to-back” wealth management operating systems for mid-market firms

- All-in-one digital platforms for financial advisors to boost productivity

Serving the mass affluent:

- B2C digital family office and private bank platforms targeting those with $100K to $1M in assets

- Democratizing access to alternative investments like real estate and private equity

Democratizing wealth management for the masses:

- From budgeting and micro-investing apps to robo-advisors and financial planning platforms

- Emerging comprehensive “super-app” platforms integrating banking, investing, tax optimization, and more

The author highlights their firm, Fidelity International Strategic Ventures, and its portfolio of innovative companies addressing these industry shifts. The wealth management landscape is rapidly evolving, and this summary covers the key trends and solutions transforming the sector.

Source: The Great Wealth Transfer

Image source: Dreamstime