Propelled by an uptick in life insurance and pensions, savings and foreign investments equity

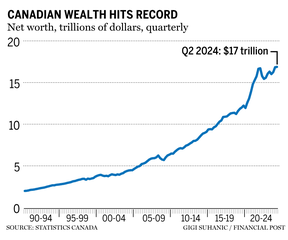

Household net worth eclipsed the $17 trillion mark for the first time, with financial assets setting a record high of $10.1 trillion in the second quarter, according to Statistics Canada.

The agency’s latest national balance sheet, released Thursday, showed household net worth inched up 0.25 per cent from the first quarter, slower than the previous quarter’s gain of 3.59 per cent.

Carrie Freestone, economist at the Royal Bank of Canada, noted big gains in financial assets in the life insurance and pension category (up 1.22 per cent) and currencies and deposits (up 1.26 per cent) as drivers.

Freestone said that while Canadian equity markets declined, there was substantial growth in the United States, with the S&P 500 index growing 3.9 per cent during the second quarter, contributing to gains in financial assets. The household savings rate climbed to 7.2 per cent from 6.7 per cent as well, which Freestone noted is typical when people are concerned about the economic outlook.

“The people that are really benefiting from appreciation to the S&P, (are) really those investors in the upper income quintile,” Freestone said, adding that the boost in savings is primarily coming from wealthier Canadians. “People in the bottom 50th percentile, essentially, are, in many cases, spending more than they earn or just barely breaking even each month or each quarter.”

Average net worth remained level at just over $1 million per household in the second quarter of 2024, Statistics Canada said, noting that wealth is not evenly distributed across all income quintiles.

Posthaste

Breaking business news, incisive views, must-reads and market signals. Weekdays by 9 a.m.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

The household debt service ratio (measured as the proportion of household disposable income going toward required interest and principal payments) grew during the second quarter as debt payment growth surpassed that of disposable income.

But Freestone said this isn’t surprising given how many households are renewing their mortgages from when rates were much lower in 2019 and 2020.

In fact, household financial liabilities, which mainly include mortgage and non-mortgage debt, jumped 1.5 per cent or $45.4 billion, the biggest increase since the third quarter of 2022.

Maria Solovieva, an economist at Toronto-Dominion Bank, said she was anticipating a gain in real estate activity, since the second quarter is typically a more active period for home sales. However, real estate ended up having the weakest second quarter in four years, with the value of residential real estate dipping 0.1 per cent compared to the previous quarter as buyers stayed on the sidelines.

Solovieva said the second quarter was “kind of a transition quarter” for the housing market, with long-term interest rates for mortgages starting off higher in the beginning of the quarter but falling toward the end of the quarter as the Bank of Canada began to cut its key rate.

“Once there’s a bit more confidence in the mortgage rate getting down, then you would expect stronger activity,” Solovieva said, adding that she doesn’t expect much of a rebound in activity in the housing market until the end of the year or early next year.

She also anticipates moderate gains in household wealth to continue in the third quarter, with growth in both Canadian and U.S. equity markets.

Source: Financial Post