In the first quarter of 2024, stock market performance was worthy of the record books. However, since the lunar eclipse, things are different and for the first time since October 2023, volatility is back as inflationary headwinds are picking up.

As has been reviewed in most newsprint and financial publications, there has been an expectation that Federal Reserve Chairman (Jerome Powell) and Bank of Canada Governor (Tiff Macklem) would start cutting interest rates in June. Alas, with recent inflation numbers rising for three consecutive months in the US (January 2024 = 3.1%, February 2024 = 3.4% and March 2024 = Mar 3.5%) it is looking less likely that June will see the first rate cut since the Covid fallout that initiated the first of several increases in interest rates since March 2022 worldwide.

The story is a little different here in Canada in that the readings are slightly lower than our American counterparts (January 2024 = 2.9%, February 2024 = 2.8% and March 2024 = 2.9%) and we remain under an overall 3% reading for the first quarter of 2024. There is still a strong possibility that rates may be cut in June here in Canada. The cut, however small, will still be a welcome relief to those mortgage holders renewing in the coming months.

The US seems to have a different trajectory:

The market’s upward momentum stalling since early April leaves most with the sense that interest rate cuts will happen later in the year. Given the forward-looking nature of stock markets, this can be a reason why there has been a pullback in the markets so thought aligns with reality.

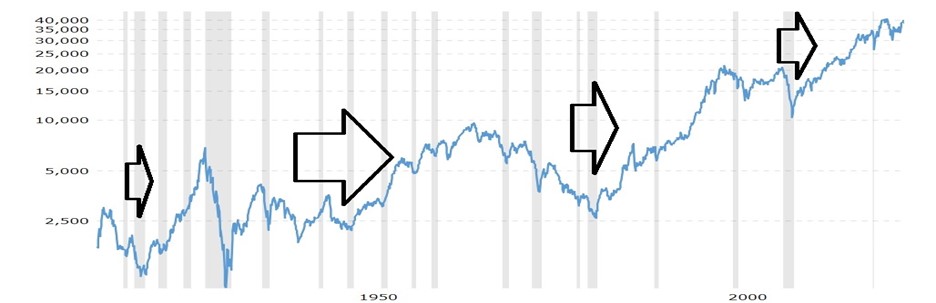

Post-World War II periods of market growth illustrate that pullbacks during an expansion phase, as expectations realign with reality, are a perfectly natural part of market movement and are possibly just a readjustment to overall expectations. This can be seen in the attached graph below of the Dow Jones Industrial Average below:

Most managers that form our Asset Allocation Models agree that this is currently a bump in the road as the BIG picture remains bullish- as the graph below shows that the market is trading below long-term averages as of Friday, April 19, 2024.

Our goals and objectives for clients remain unchanged:

Well run actively managed portfolios that provide stability, long-term performance and, most of all, protection from downside risk for clients to remain focused on their lifestyle and day-to-day living are our priority.

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This newsletter was written, designed and produced by John A. Leroux, an Investment Funds Advisor with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc.

The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities. Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.